As we have seen in just the past few years, fossil fuel prices can vary dramatically over very short periods of time. Creating greater certainty regarding steady increases in fossil fuel prices over the coming decade would have an enormous impact on private sector investments in both alternative energy and energy efficiency. Cap and trade is the right debate to be having because it focuses the discussion on how to change the fundamental economics of fossil-based energy. But ultimately cap and trade is the wrong solution; superior means exist to achieve the results we need not only for the environment but also for national security and our economy. A better solution is a strategically targeted “ceiling” tax on carbon combined with a tax dividend.

Cap and trade sounds good on the surface. Seemingly it would allow the market the freedom to choose among implementing technologies that reduce greenhouse gas emissions, paying to use existing technologies that emit greenhouse gases, or paying for offsets from another entity. But cap and trade is inherently flawed in its complexity and the slow rate at which it can propel change. The potential for loopholes and corruption, both through the specifics of how the law is implemented and the trading markets that will be created, are enormous. If you have read my blog previously, you may be surprised to hear me come out against a seemingly market-based solution like cap and trade. Many assume that because cap and trade worked for acid rain, it will work for greenhouse gases. But for markets to work well there needs to be transparency around both price and what actually is being purchased. As the graphics shown help illustrate, the complexity of greenhouse gases are enormous compared to the simplicity of sulfur emissions from coal plants. The challenges around accurate and transparent accounting of how much carbon is emitted or “re-sequestered” through an offset is fairly daunting. There have already been significant challenges around carbon offsets with the European cap and trade efforts. So far in Europe, the impact on greenhouse gas emissions has been much less than desired upcoming book by Roger Pielke). Because of these factors, not only does cap and trade create risk of corruption because of the challenges around defining exactly what has been emitted or how much an offset has recaptured, but its ability to actually achieve the desired reduction in greenhouse gases also falls into question.

upcoming book by Roger Pielke). Because of these factors, not only does cap and trade create risk of corruption because of the challenges around defining exactly what has been emitted or how much an offset has recaptured, but its ability to actually achieve the desired reduction in greenhouse gases also falls into question.

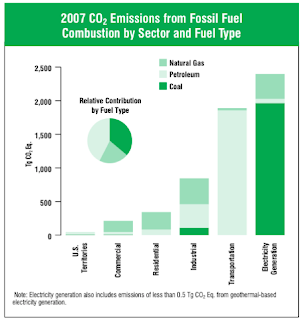

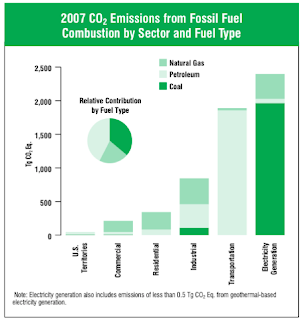

Efforts to implement a cap and trade system that would be truly comprehensive would treat all long-lived greenhouse gases as equal. To make any meaningful difference, the price of carbon must be set high enough to move the meter significantly on the cost of fossil fuels. Many experts estimate that price to be as much as ten times the current price in Europe. As a result, if a cap and trade system is actually going to result in a meaningful reduction in greenhouse gas it will have an enormous impact on the economy given the scope of activities that generate greenhouse gases. In addition, the sheer process of requiring businesses to account for their emissions would lead to significant wasteful administrative costs beyond the cost of the carbon emissions themselves. Such a requirement would, however, create a great jobs program for accountants, attorneys and even investment bankers who would get paid to navigate the complicated mess that would result. This reality is why many cap and trade proposals end up being limited to areas of highly concentrated emissions that are easy to track. This effectively means focusing on power plants, which represent about 39% of the impact-weighted greenhouse gas emissions (of which 85% is from coal-fired plants). And most proposals generally leave transportation -- which produces about 33% of the impact-weighted U.S. greenhouse gases – largely unaffected.

Efforts to implement a cap and trade system that would be truly comprehensive would treat all long-lived greenhouse gases as equal. To make any meaningful difference, the price of carbon must be set high enough to move the meter significantly on the cost of fossil fuels. Many experts estimate that price to be as much as ten times the current price in Europe. As a result, if a cap and trade system is actually going to result in a meaningful reduction in greenhouse gas it will have an enormous impact on the economy given the scope of activities that generate greenhouse gases. In addition, the sheer process of requiring businesses to account for their emissions would lead to significant wasteful administrative costs beyond the cost of the carbon emissions themselves. Such a requirement would, however, create a great jobs program for accountants, attorneys and even investment bankers who would get paid to navigate the complicated mess that would result. This reality is why many cap and trade proposals end up being limited to areas of highly concentrated emissions that are easy to track. This effectively means focusing on power plants, which represent about 39% of the impact-weighted greenhouse gas emissions (of which 85% is from coal-fired plants). And most proposals generally leave transportation -- which produces about 33% of the impact-weighted U.S. greenhouse gases – largely unaffected.

“So what?” you say. Let’s focus on reducing the 39% that is largely from coal-fired plants, right? From an environmental perspective it does not matter where we reduce emissions – just that they are reduced. But from an economic and national security standpoint it matters significantly. The U.S. is home to roughly 25% of the world’s coal and supplies virtually all the coal Americans consume. Meanwhile, the U.S. imports the majority of petroleum that we consume. Reducing consumption of coal will not strengthen our national security, and the most immediate effect on our economy will be negative. Even if one doesn’t believe those are important factors (hard for me to fathom but I know some feel that way), I suspect that everyone would agree that the political ability to implementsomething that moves the meter is critical. And a policy that appeals to the left and right of the political spectrum holds the best promise.

“So what?” you say. Let’s focus on reducing the 39% that is largely from coal-fired plants, right? From an environmental perspective it does not matter where we reduce emissions – just that they are reduced. But from an economic and national security standpoint it matters significantly. The U.S. is home to roughly 25% of the world’s coal and supplies virtually all the coal Americans consume. Meanwhile, the U.S. imports the majority of petroleum that we consume. Reducing consumption of coal will not strengthen our national security, and the most immediate effect on our economy will be negative. Even if one doesn’t believe those are important factors (hard for me to fathom but I know some feel that way), I suspect that everyone would agree that the political ability to implementsomething that moves the meter is critical. And a policy that appeals to the left and right of the political spectrum holds the best promise.

Tax and dividend, whereby a tax is placed on carbon and some, if not all, of the proceeds are distributed back to those who paid the tax, is a concept that has begun to receive discussion as a potential alternate solution. Such a system taxes based on consumption but the dividends are paid out without respect to specific consumption. So, the motivation to move to alternative fuels or implement energy efficiency remains because the dividend will still be received even if tax payment is reduced. Yet, the sting of the tax is reduced by receipt of the dividend. Tax and dividend eliminates many of the problems associated with the complexity and lack of transparency with cap and trade and it largely leverages systems already in place to tax things like gasoline, coal, etc. However, it still is flawed in that it treats all carbon as being equal. Again, while all emitted CO2 is equal from an environmental standpoint, it is not from an economic or national security standpoint. In addition, the greater the scope of the tax, the more interest groups it will upset and the less likely it is that it can ever pass Congress to become law.

The better solution, both from an efficacy and political standpoint, than cap and trade or tax and divided is a strategically placed “ceiling” tax on carbon combined with a tax dividend. Our greatest opportunity lies at the nexus where greenhouse gases are reduced, national security is strengthened and our economy is at least not harmed. As a result, the first element of the solution should focus on petroleum consumption, which is predominantly consumed in vehicles and the first strategic place for a “ceiling” tax is on CO2 emissions from fossil-based transportation fuels used in automobiles and trucks. This is effectively a gas tax, except it would apply to gasoline, diesel and any future form of fossil-based fuel sold for ground transportation and would be based on the amount of non-renewable CO2 emitted upon combustion. In addition, the tax rate would be determined by the difference between the price the retailer/vendor pays for the fuel and a pre-determined fixed maximum charge to the consumer (individuals and businesses alike). If the ambient price of the fuel commodity increases, the tax that is charged would decrease. Thus, it creates a “ceiling” on the tax where there is an ambient price at which the tax would no longer be charged. Implementing the tax in this manner accomplishes several objectives:

upcoming book by Roger Pielke). Because of these factors, not only does cap and trade create risk of corruption because of the challenges around defining exactly what has been emitted or how much an offset has recaptured, but its ability to actually achieve the desired reduction in greenhouse gases also falls into question.

upcoming book by Roger Pielke). Because of these factors, not only does cap and trade create risk of corruption because of the challenges around defining exactly what has been emitted or how much an offset has recaptured, but its ability to actually achieve the desired reduction in greenhouse gases also falls into question.

Tax and dividend, whereby a tax is placed on carbon and some, if not all, of the proceeds are distributed back to those who paid the tax, is a concept that has begun to receive discussion as a potential alternate solution. Such a system taxes based on consumption but the dividends are paid out without respect to specific consumption. So, the motivation to move to alternative fuels or implement energy efficiency remains because the dividend will still be received even if tax payment is reduced. Yet, the sting of the tax is reduced by receipt of the dividend. Tax and dividend eliminates many of the problems associated with the complexity and lack of transparency with cap and trade and it largely leverages systems already in place to tax things like gasoline, coal, etc. However, it still is flawed in that it treats all carbon as being equal. Again, while all emitted CO2 is equal from an environmental standpoint, it is not from an economic or national security standpoint. In addition, the greater the scope of the tax, the more interest groups it will upset and the less likely it is that it can ever pass Congress to become law.

The better solution, both from an efficacy and political standpoint, than cap and trade or tax and divided is a strategically placed “ceiling” tax on carbon combined with a tax dividend. Our greatest opportunity lies at the nexus where greenhouse gases are reduced, national security is strengthened and our economy is at least not harmed. As a result, the first element of the solution should focus on petroleum consumption, which is predominantly consumed in vehicles and the first strategic place for a “ceiling” tax is on CO2 emissions from fossil-based transportation fuels used in automobiles and trucks. This is effectively a gas tax, except it would apply to gasoline, diesel and any future form of fossil-based fuel sold for ground transportation and would be based on the amount of non-renewable CO2 emitted upon combustion. In addition, the tax rate would be determined by the difference between the price the retailer/vendor pays for the fuel and a pre-determined fixed maximum charge to the consumer (individuals and businesses alike). If the ambient price of the fuel commodity increases, the tax that is charged would decrease. Thus, it creates a “ceiling” on the tax where there is an ambient price at which the tax would no longer be charged. Implementing the tax in this manner accomplishes several objectives:

- It creates clarity, certainty and stability around the price that alternatives will need to compete with.

- It sends a clear political message that this tax is not forever; it has a built-in mechanism to end when the ambient market price catches up with the artificial price created by the tax.

- It puts a limit on the pain inflicted at the pump. If fuel prices spike, the tax will diminish and even go to zero if the maximum charge to consumers is exceeded.

Now, what to do with the revenue? We must ensure that the negative impact on our economy is minimized as much possible. In addition, we have to be realistic and create something that can fly politically. As a result, the tax revenue should be sent right back to the consumers who paid it. For individuals, the amount received could be based on the size of the family to reflect the likely increased transportation needs. Economically speaking, the dollars received by each family will be much more meaningful to a low-income family. Yet, the payment is not based on income – something for Democrats and Republicans to celebrate. For businesses, we must endeavor to avoid making specific businesses non-competitive. If a business has a transportation intensive business, the cost increase could be substantial. So, distribution to companies could be based on their fuel consumption for transportation over a multi-year period prior to enactment of the tax. That way, transportation-intensive companies will receive a much larger share than those that use little transportation directly in their business.

What about the impact on the oil industry? No doubt that such a tax would have an impact on oil consumption and therefore production. It may even be politically required to dividend some of the tax proceeds back to the oil industry. After all, democracy is the art of the possible. This would likely mean a smaller oil industry to the extent that the industry doesn’t redirect its efforts to other profitable business efforts (e.g., geothermal, solar, etc.). However, with a tax on transportation fuels, there would be a clear economic upside to the change. The clarity provided with respect to future prices of gasoline and diesel would provide significant impetus and support for private sector investments in renewables as well as vehicle energy efficiency. In addition, such clarity would spur significant economic growth in the automotive industry as consumers become eager to find energy efficient or alternative energy vehicles. One need only look at what happened with the sales of hybrid vehicles when gas prices spiked a few years ago. The auto industry would see a boom as consumers looked to switch to vehicles that consume less fossil fuels.

President Obama’s desired goal is a 17% reduction by 2020 from 2005 emission levels. If the tax is set at a high enough level, studies indicate it would drive significant change in buying decisions and driving behavior of consumers. A key to the success of the tax is that it creates long-term certainty with consumers regarding the likely price of gasoline and diesel. A Congressional Budget Office Study found that a 10% long-term increase in fuel prices would result in roughly a 4% reduction in fuel consumption (through a combination of reduced driving as well as purchase of different vehicles). If the ceiling tax were set based on a target price of $5 per gallon retail price for gasoline, this would create long term visibility into a price increase and would imply we could see a reduction in fuel consumption (and corresponding emissions) of 40%-50% representing a 13%-17% reduction in overall greenhouse gas emissions. The U.S. consumes more than 6x the gasoline per capital than Europe and one reason is that gasoline costs 2-3x as much at the pump than the U.S. What the CBO study did not take into account (given the challenge of doing so) is what happens to petroleum consumption when alternative fuel vehicles then become cost-competitive. I would suggest that the accelerated innovation that would occur in such vehicles once businesses knew they would be competing with a $5/gallon price would drive even greater reductions in greenhouse gas emissions and petroleum consumption well beyond 17% in 10 years.

Clearly, such reductions are much less meaningful from an environmental perspective if carbon emissions elsewhere were to increase. Given that electric vehicles are a probable future for some vehicles, we must address the emissions created by electricity production. Otherwise, we will simply push CO2 creation from the tailpipe to the smokestack. But rather than a complex loophole- and scandal-fraught cap and trade system, a strategically placed ceiling tax on CO2 emissions and corresponding dividend should also be used in the utility industry. The challenge here is that just like cap and trade, in order to have a meaningful impact regarding the business decisions made on utility plants, the price of carbon must be set fairly high. Because electricity costs impact every person and business in the nation, a carbon tax applied to power plants significant enough to be meaningful would have a broad-based negative impact on the economy. Everything would become more expensive.

Instead of a blanket tax, the ceiling tax on CO2 from electricity production should be much more strategic. First, the tax placed on existing plants should be fairly modest and intended primarily to generate tax revenue that would be utilized specifically to provide funding to the coal industry for clean coal and sequestration technologies. That is not only the politically correct move; it is economically smart given our vast coal resources. A tax of just $2 per million metric tons of carbon would generate roughly $5 billion a year in tax revenue (U.S. utilities generate roughly 2,400 million metric tons per year). Yet, it would add an average of about one tenth of a cent to the cost of every kilowatt-hour (U.S. total electricity production is roughly 4,100 billion kilowatt hours per year) or roughly a .01% increase in retail price. Second, the tax on new plants built after a couple-year grace period for those already being constructed, should be set at a much higher level that ramps up over time to a capped amount. An initial tax rate of roughly $30 per metric ton would equate into a cost increase of about 3 cents per kilowatt-hour for the worst offending coal-powered electricity generation. However, the specific amount of the tax should also vary based on the price of the underlying commodity (e.g., coal or natural gas). That way, if there were a spike in a commodity price (like with natural gas a few years ago), the tax is automatically reduced or eliminated, thereby eliminating excessive spikes in electricity prices.

To make a carbon tax on utilities achieve the desired goal of driving a change in decisions regarding which type of plants to build, it is critical that utilities are not allowed to work the tax into their rate base - they must eat the tax cost or implement new plants that emit less or no CO2. In addition, when plants reach a set time frame after the end of their depreciation period, they would begin to be subject to the higher tax on new plants. The incentive must be squarely placed on utilities to implement low carbon or no carbon means – all of which they can work into their rate base. That means implementing renewable, nuclear, sequestration and likely some additional natural gas. Given that the incremental plants will, by and large, create more expensive electricity than the base coal plants, utilities will have increased incentives to promote energy efficiency and implement the smart grid. Until technology innovation allows otherwise, most incremental electricity load above the current base will likely cost more to deliver. Such a tax, if set high enough on new plants, would likely create something akin to a cap on any increases in carbon emissions by utilities. As aging plants are replaced or retrofitted, reductions in emissions would begin. In 10 years, if the vast majority of new electricity production beyond what was currently being built has been low- or no carbon and if just 15% of aging coal plants are replaced with low or no-carbon emitting alternatives, we would see a reduction from 2005 utility emissions of 3%-6% on top of the at least 13%-17% reductions from action on transportation fuels but without a severe negative impact on the economy. And the clean coal and sequestration technologies developed from the R&D generated through the taxes would hopefully enable an acceleration in reductions as they are able to be implemented in the following years.

In making decisions about how to reduce green house gas emissions, as a nation we cannot and should not focus solely on the issue of global warming while ignoring the equally important goals of maintaining our national security and economic strength. We must implement a system that changes the economics of energy in a way that supports all of these goals. Not only will cap and trade be unable to achieve these three goals, but without an extremely high price on carbon that likely cripples our economy it won’t even have a significant impact on the single goal of reducing green house gas emissions. A system that does not focus first on our consumption of petroleum has little chance of strengthening our economy or national security. In addition, to be successful, we must create greater clarity over long-term fuel price that the alternatives must compete with in order to provide the impetus for private sector investment in energy efficiency and alternative energy. Cap and trade cannot give this clarity and the government cannot simply buy our way out of this problem. We must have the innovation, creativity and financial power of the private sector motivated to making the scale of change that is required. A strategically targeted ceiling tax on carbon with focused use of the dividends could create the log term clarity needed in the market and will motivate the private sector to dramatically increase investment in the type of innovation and change that is the source of ours (and the world’s) prosperity.